Custom Private Equity Asset Managers - Questions

Wiki Article

The 6-Second Trick For Custom Private Equity Asset Managers

You have actually most likely heard of the term exclusive equity (PE): buying business that are not openly traded. Roughly $11. 7 trillion in possessions were taken care of by private markets in 2022. PE firms seek chances to gain returns that are better than what can be accomplished in public equity markets. However there might be a couple of things you don't comprehend concerning the sector.

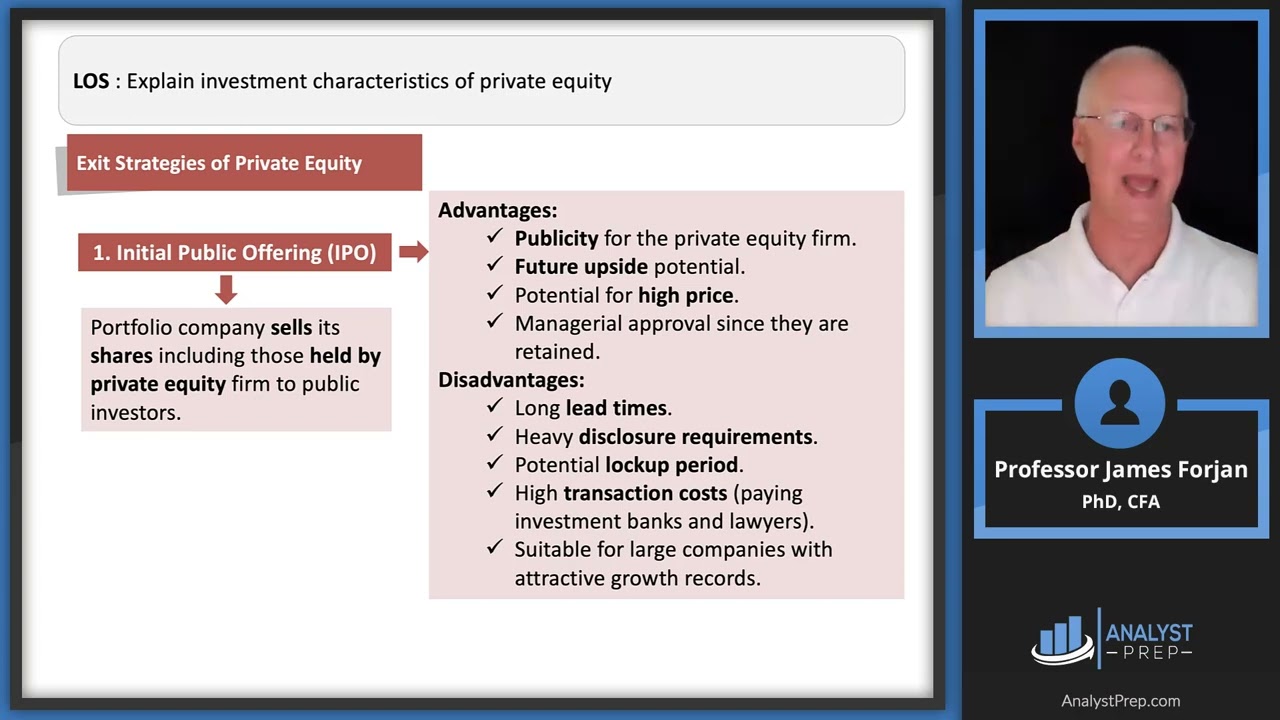

Companions at PE companies increase funds and handle the cash to generate favorable returns for investors, generally with an financial investment perspective of in between four and 7 years. Exclusive equity firms have a range of financial investment preferences. Some are rigorous sponsors or easy capitalists entirely depending on management to grow the company and produce returns.

pop over to these guysBecause the finest gravitate toward the bigger deals, the middle market is a substantially underserved market. There are a lot more sellers than there are very skilled and well-positioned money specialists with comprehensive purchaser networks and resources to take care of an offer. The returns of personal equity are typically seen after a couple of years.

The Single Strategy To Use For Custom Private Equity Asset Managers

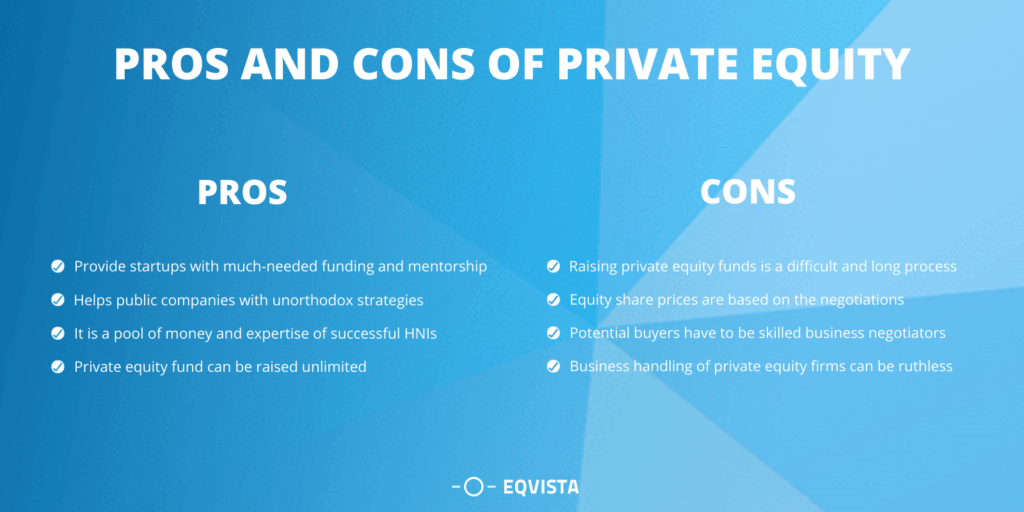

Traveling below the radar of large international firms, most of these tiny business usually give higher-quality client service and/or niche product or services that are not being supplied by the big conglomerates (https://telegra.ph/Unlocking-Prosperity-TX-Trusted-Private-Equity-Company-and-Private-Asset-Managers-in-Texas-12-05). Such advantages bring in the passion of private equity firms, as they have the understandings and wise to manipulate such chances and take the company to the next degree

A lot of managers at profile companies are provided equity and bonus settlement structures that award them for hitting their monetary targets. Personal equity opportunities are frequently out of reach for individuals that can't invest millions of bucks, yet they shouldn't be.

There are guidelines, such as restrictions on the accumulation quantity of cash and on the number of non-accredited capitalists (Asset Management Group in Texas).

Unknown Facts About Custom Private Equity Asset Managers

One more downside is the absence of liquidity; once in an exclusive equity transaction, it is not easy to get out of or offer. With funds under monitoring already in the trillions, private equity companies have ended up being eye-catching investment cars for well-off individuals and institutions.

Now that access to private equity is opening up to even more private capitalists, the untapped potential is coming to be a truth. We'll start with the major debates for spending in personal equity: Just how and why exclusive equity returns have historically been greater than various other properties on a number of levels, How including private equity in a portfolio influences the risk-return profile, by aiding to diversify versus market and intermittent risk, Then, we will certainly describe some key considerations and risks for private equity investors.

When it pertains to introducing a new possession right into a portfolio, the most standard factor to consider is the risk-return account of that property. Historically, private equity has shown returns comparable to that of Emerging Market Equities and higher than all other standard asset courses. Its fairly reduced volatility combined with its high returns makes for an engaging risk-return account.

Custom Private Equity Asset Managers for Dummies

Personal equity fund quartiles have the best array of returns throughout all alternative property courses - as you can see listed below. Technique: Internal price of return (IRR) spreads computed for funds within classic years individually and after that averaged out. Typical IRR was calculated bytaking the standard of the average IRR for funds within each vintage year.

The takeaway is that fund option is crucial. At Moonfare, we execute a rigorous choice and due persistance process for all funds listed on the system. The effect of adding exclusive equity into a profile is - as constantly - dependent on the profile itself. Nevertheless, a Pantheon research from 2015 suggested that consisting of personal equity in a profile of pure public equity can unlock 3.

On the other hand, the very best private equity companies have accessibility to an also bigger swimming pool of unknown possibilities that do not encounter the same examination, along with the sources to perform due diligence on them and determine which are worth buying (Asset Management Group in Texas). Investing at the very beginning indicates greater threat, however for the firms that do succeed, the fund take advantage of higher returns

What Does Custom Private Equity Asset Managers Do?

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Both public and private equity fund supervisors commit to investing a percent of the fund yet there continues to be a well-trodden issue with aligning interests for public equity fund administration: the 'principal-agent trouble'. When a capitalist (the 'principal') works with a public fund supervisor to take control of their funding (as an 'agent') they entrust control to the supervisor while maintaining ownership of the assets.

In the situation of personal equity, the General Partner doesn't simply gain a monitoring fee. They likewise gain a percentage of the fund's revenues in the form of "bring" (normally 20%). This guarantees that the interests of the supervisor are aligned with those of the capitalists. Personal equity funds likewise alleviate an additional form of principal-agent trouble.

A public equity investor ultimately wants one point - for the management to increase the supply rate and/or pay returns. The financier has little to no control over the decision. We revealed over the number of exclusive equity approaches - particularly majority acquistions - take control of the operating of the firm, making sure that the long-term worth of the company precedes, rising the roi over the life of the fund.

Report this wiki page